31+ Additional borrowing calculator

Get Offers From Top 7 Online Lenders. Further advance payment calculator Find out how much more your client can borrow Further advance amount required Key the interest rate on which the further advance will be calculated Repayment type.

G201504061231515332622 Jpg

This mortgage calculator will show how much you can afford.

. The minimum mortgage term for additional borrowing is two years. Use the slider to set the. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Let us know a bit about your mortgage and your spending to see what extra we may be able to lend you on your mortgage. If a revaluation applies there is a 70 valuation fee to pay which is non-refundable. For a 100000 loan at 6 percent interest for 30 years the monthly payment is 59955.

The calculation uses your Debt Servicing Ratio which is found by dividing your total monthly repayments by your total monthly income. Fill in the entry fields and click. Its Never Been A More Affordable Time To Open A Mortgage.

School fees exclude household expenditure such as gas electric and food. Your total monthly payments of any outstanding loans. This is so we can assess your current financial situation and make the right recommendation for your needs.

Even borrowing 5000 at an interest rate of 6. Please see the assumptions we have made below the calculator. The Affordability Calculator will give you a quick estimate of how much extra your client can borrow.

Additional borrowing applications will not be permitted within 6 months of completion of the original mortgage. How to use our calculator. The results from this calculator should be used as an indication only.

Bank Has The Tools For Your Mortgage Questions. The term for the new lending must be at least two months shorter than the main mortgage account. Ad Need a Business Loan.

Even a small change can have a big impact. With mortgage cycling the borrower sends in an additional. Some things to be aware of.

If youve decided to go ahead with some additional borrowing on a mortgage then you may need a new valuation sometimes called a revaluation. This allows time for the additional borrowing application to be processed so. Your total outstanding credit card balances.

Please do not include any non-sterling income below. Most lending institutions will lend to a maximum ratio of 32 with a 2 loading on loan rates. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest payments thats just on the extra borrowing Yet borrowing 5000 at an interest rate of 3 over three years perhaps through a personal loan would cost you 23141 in interest payments.

Even if you pay it off in full each month you still need to enter this amount. As part of an affordability assessment lenders will check your credit report to see how youve managed debt in the past. The minimum mortgage term for additional borrowing is two years.

It is advised that you consult your financial adviser before taking out a loan. If youre thinking of applying to borrow more its important that you talk to us first. The first step in buying a house is determining your budget.

Please click on where these appear for advice on how to complete the section. This calculator is for illustrative purposes only. This breaks down to a payment of 500 towards interest and 9955 towards the principal.

Affordability can only be assessed on submission of a full application for this type of lending. Calculate what you can afford and more. Its a good idea to check your credit.

The maximum term is 40 years which is subject to our lending into retirement criteria. Call us on 0345 300 8000. But ultimately its down to the individual lender to decide.

Choose how much you want to save or borrow. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest payments thats just on the extra borrowing Yet borrowing 5000 at an. This calculator is designed to help you work out your borrowing power based on your current financial position.

Other committed monthly outgoings. Results do not represent either quotes or pre-qualifications for a loan. Enter the amount into the box.

This will show you how the interest rate affects your borrowing or saving. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow the interest rate how much time you have to pay it back your credit score and income.

Pin By Kim Loeffler Mortgages Made On Mortgages Made Simple Mortgage Checklist Mortgage Mortgage Marketing

Mortgage Calculator Valley West Mortgage

Prosper 424b3 20160630 Htm

Img004 Jpg

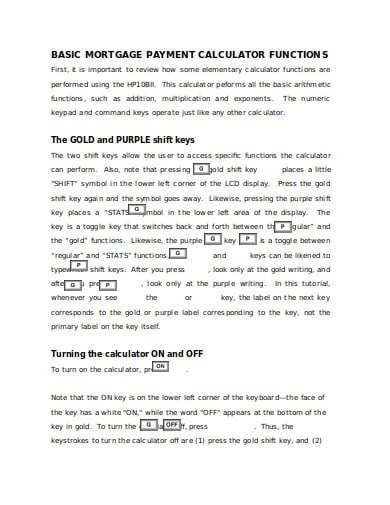

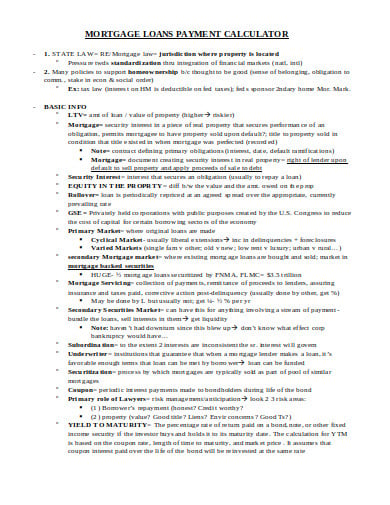

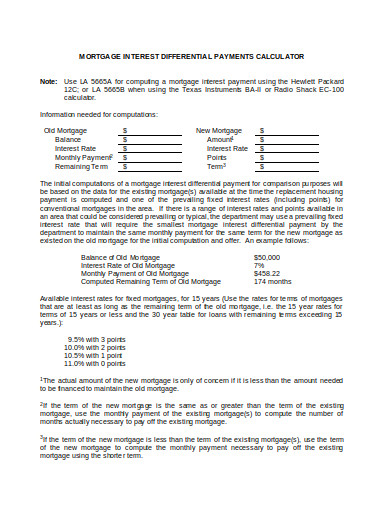

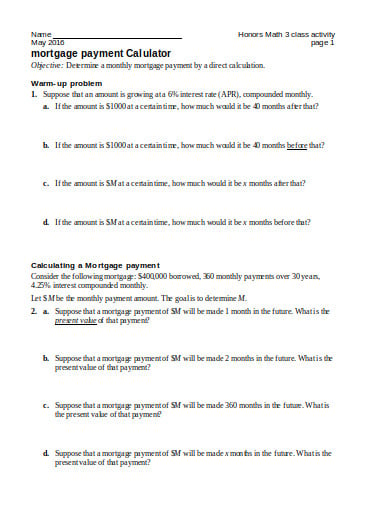

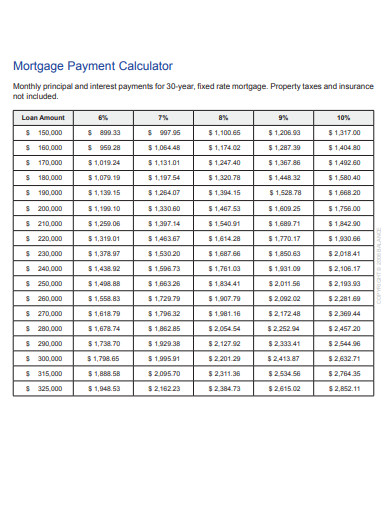

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Interest Only Loan Calculator For Excel Amortization Schedule Loan Repayment Schedule Excel Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Mortgage Calculator And Amortization Table With Extra Payments Additional Principal Excel Te Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

2

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Loan Amortization Schedule Simple Amortization Schedule Schedule Template Excel Templates

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Debt Calculator Loan Payoff Student Loans